53+ how much of your income should you spend on mortgage

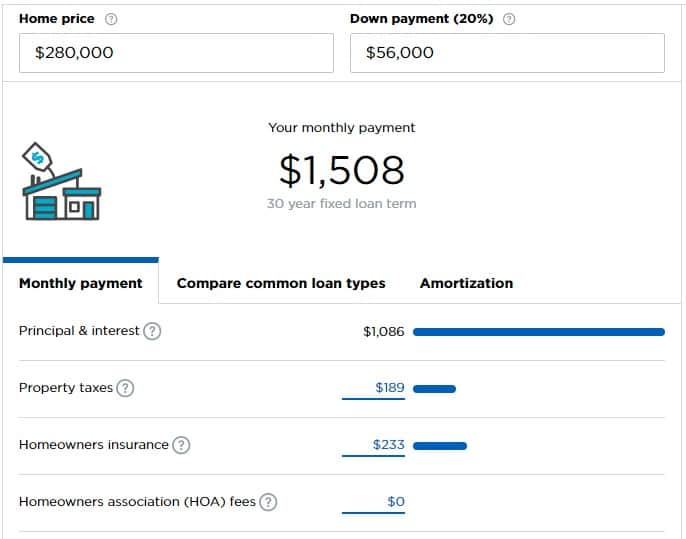

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Estimate your monthly mortgage payment.

53 Of The Most Beautiful Free Printables To Organize Your Whole Life The Printables Bible

Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly.

. Lock In Your Low Rate Today. Ad See how much house you can afford. Ad Compare Home Financing Options Online Get Quotes.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Special Offers Just a Click Away. Get Your Home Loan Quote With Americas 1 Online Lender.

Choose Smart Apply Easily. Estimate your monthly mortgage payment. Ad Calculate and See How Much You Can Afford.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your mortgage. This portion of your budget should cover required costs such as.

Web According to this rule your mortgage payment shouldnt be more than 28 of your monthly pre-tax income and 36 of your total debt. This is also known as the. Ad See how much house you can afford.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Necessities are the expenses you cant avoid.

Ad Compare Home Financing Options Online Get Quotes. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Ad Purchasing A House Is A Financial And Emotional Commitment.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Ad Calculate Your Payment with 0 Down.

5000 x 028 1400 5000. Web 50 of your income. And you should make.

Find Out If You Qualify For a Low Rate in Minutes. We Are Here To Help You. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. Get Your Home Loan Quote With Americas 1 Online Lender. If you choose to spend over that amount on your.

With a general budget you want. Web As a general rule you shouldnt spend more than about 33 of your monthly gross income on housing. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much To Spend On A Mortgage Based On Salary Experian

What Percentage Of Your Income To Spend On A Mortgage

Affordability Calculator How Much House Can I Afford Zillow

How Much Of My Income Should Go Towards A Mortgage Payment

Calameo The Fa Grassoots Football Strategy 2021 2024

How Much House Can I Afford

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To Mortgage

What Percentage Of Income Should Go To A Mortgage Bankrate

Here S How To Figure Out How Much Home You Can Afford

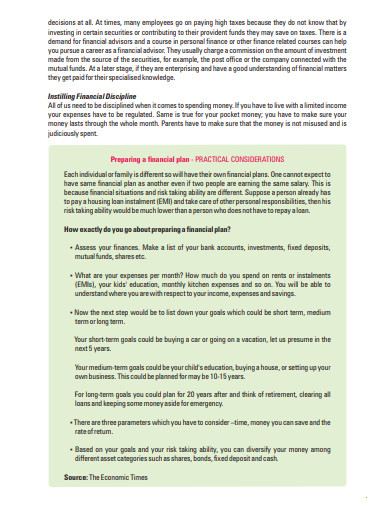

Personal Finance Essentials 3 Examples Format Pdf Examples

Bloganuary 2023 Jan 24 Just Writing

What Percentage Of Your Income Should Go To Mortgage Chase

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Walmart S Food Stamp Scam Explained In One Easy Chart Jobs With Justice

Friday S Guest Top 10 Interest Co Nz